delayed draw term loan commitment fee

DELAYED DRAW TERM LOAN CREDIT AGREEMENT. With a DDTL you can withdraw funds several times from a predetermined loan amount.

Sponsors Holster Revolvers For Delayed Draw Loans Churchill Asset Management

Historically delayed draw term loans DDTLs were generally seen in the middle market non-syndicated world of leveraged loans.

. ARTICLE I DEFINITIONS AND ACCOUNTING TERMS 1. When a loan modification or exchange transaction involves the addition of a delayed draw loan commitment with the same lender we believe it would not be appropriate to include the unfunded commitment amount of delayed draw term loan in the 10 test since the commitment is not funded on the modification date. Means March 31 2011 after giving effect to any funding of a Term B-3 Loan on such date.

Historically delayed draw term loans DDTLs were generally seen in the middle market non-syndicated world of leveraged loans. Delayed Draw Term Loan Commitment Percentage shall mean for each Term Loan Lender the percentage identified as its Delayed Draw Term Loan Commitment Percentage on Schedule 11c or in the. DDTLs were used in bespoke arrangements by borrowers who wanted to get incremental committed term loan capacity often for future acquisitions or expansions but wanted.

The withdrawal periods are also determined in advance. DDTLs carry ticking fees akin to. That is the fees are paid whether or not the funds are ever drawn down.

When a reporting entity enters into a delayed draw debt agreement it pays a commitment fee to the lender in exchange for access to capital over the contractual term. A delayed draw term loan is a special feature in a term loan that stipulates that the borrower can withdraw predefined amounts of the total pre-approved amount of a term loan at contractual times. THIS DELAYED DRAW TERM LOAN AGREEMENT this Agreement is entered into as of May 5 2008 among PUBLIC SERVICE COMPANY OF NEW MEXICO a New Mexico corporation as Borrower the Lenders MORGAN STANLEY SENIOR FUNDING INC.

The fee amount accumulates on the portion of the undrawn loan until the loan is either fully used terminated by the borrower or the commitment period expires. The panel will review the evolving uses of delayed draw term loans DDTLs in leveraged buyouts LBOs and other private equity transactions and critical points of negotiation including conditions precedent to making draws ticking fees loan term and fronting arrangements in. The commitment fee is typically lower than the interest rate that is charged on the drawn portion of the loans.

This Credit Agreement dated as of August 31 2012 is among Par Petroleum Corporation a Delaware corporation Borrower the Guarantors party hereto from time to time together with the Borrower each a Credit Party and collectively the Credit Parties the lenders party hereto from time to time the Lenders and. DDTLs carry ticking fees akin to commitment fees which are payable during the commitment period on the unused portion of the DDTL commitment. The loans come with a host of fees and some restrictions but often are an appealing way to finance growth through acquisition in the middle markets.

An acquisition or equipment line a delayed-draw term loan. A commitment fee pays for the cost of reserving the unused portion of your credit line. Like revolvers delayed-draw loans carry fees on the unused portion of the facilities.

And WACHOVIA BANK NATIONAL ASSOCIATION as Co-Syndication Agents MERRILL LYNCH. In syndicated term loan financings ticking fees have often been priced at half the margin within some. Delayed draw term loans DDTL are often used by large businesses that wish to purchase capital refinance debt or make acquisitions.

The Company shall pay to the Administrative Agent for the account of each Lender in accordance with its Applicable Percentage a commitment fee the Delayed Draw Term Loan Commitment Fee in an amount equal to the product of i 040 per annum times ii the actual daily amount. Delayed draw term loans are a flexible way for borrowers usually with the backing of sponsors to finance incremental acquisitions after a significant transaction. Funding and maintaining its Loans and its Commitment.

This contrasts with commitment fees on revolvers of 50bp. The Delayed Draw Term Commitment Ticking Fees shall accrue at all times from and including the Closing Date until but excluding the earlier of the Delayed Draw Term Loan Date and the date on which the Delayed Draw Term Commitments expire including at any time during which one or more of the conditions in Article IV is not met and shall be. A fee paid by a borrower on the unused portion of its revolving credit loans or delayed-draw term loans to compensate the lenders for their commitment to make the funds available to the borrower for a certain period of time.

A revolving credit line allows borrowers to draw down repay and reborrow. Fee Letter means that certain fee letter dated November 16. The commitment fee is typically lower than the interest rate that is charged on the drawn portion of the.

It guarantees that the entire credit line will be granted to you instead of another individual or business. Today draw periods stretch to three years with the final maturity matching that of the associated term loan tranche typically six or seven years. While commitment fees vary some lenders opt to charge you a percent of your unused credit amount at the end of each quarter.

Delayed Draw Term Loans February 13 2018 Time to Read. This CLE course will discuss the terms and structuring of delayed draw term loans. Define Delayed Draw Term B Commitment Termination Date.

These ticking fees start at 1. Delayed Draw Term Loans. Delayed draw term loans include a ticking fee a fee paid from the borrower to the lender.

The facility acts much like a corporate credit card except that borrowers are charged an annual commitment fee on unused amounts which drives up the overall cost of borrowing the facility fee. A draw period is the amount of time you have to withdraw funds. 137500000 DELAYED DRAW TERM LOAN FACILITY Table of Contents Page.

Delayed Draw Term Loan Commitment Fee. A fee paid by a borrower on the unused portion of its revolving credit loans or delayed-draw term loans to compensate the lenders for their commitment to make the funds available to the borrower for a certain period of time.

Houlihan Lokey Advises Cerberus Capital Management Transaction Details

Financing Fees Deferred Capitalized Amortized

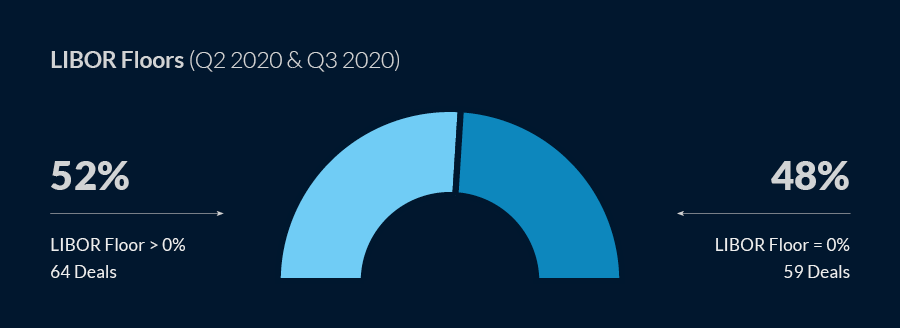

New Libor Floor Provisions Market Trends 2020 2021

Promissory Note Form Printable Forms Templates Promissory Note Notes Form

Financing Fees Deferred Capitalized Amortized

How To Calculate An Interest Reserve For A Construction Loan Propertymetrics

Delayed Draw Term Loan Ddtl Overview Structure Benefits

Infographics Types Of Bank Guarantees Bg Providers Trade Finance Bank Infographic

A First Time Buyers Guide To Understanding The Construction Loan Process Newhomesource Home Improvement Loans Construction Loans Home Construction

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/DrawDown-72a632110a47496a9fa346b7c63eb557.jpeg)

What Is A Delayed Draw Term Loan Ddtl

Houlihan Lokey Advises U S Oral Surgery Management Transaction Details

Capital Markets Looking At The Bank Loan Syndication

/GettyImages-1162280946-fdd66d8f3cd94022885927e27d132192.jpg)

/GettyImages-1327106740-4c1da9360d894c399ea83c42a4b9016e.jpg)